'How long do you have to be somewhere for it to count as living there'

Oct 11, 2003 ☰ did I “move” to guatemala? how long do you have to live in a foreign place before you stop being a tourist?

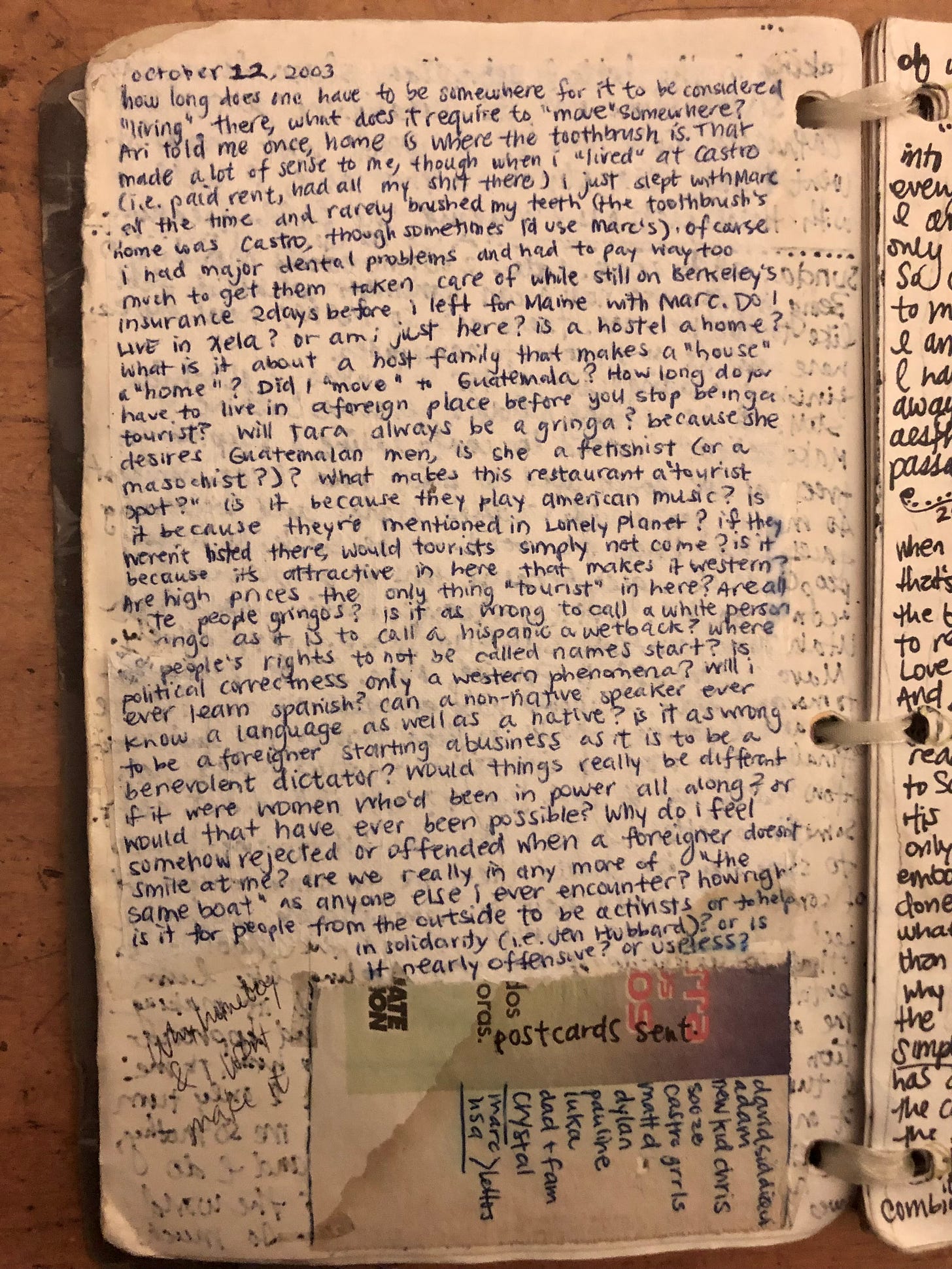

Above, a series of questions I wrote in a handmade notebook in 2003. Now, 20 years later, it’s late June 2024 and most of those questions remain unanswered. Sure, nothing is certain but death and taxes, but there are a few things I can kind of answer.

Is a hostel a home?

Fuck it, why not? Elizabeth Taylor lived in a hotel. Marilyn Monroe lived at the Hotel Bel-Air for a decade. Sure, a hostel doesn’t quite have the cachet of a hotel. But then again, Patti Smith and Janis Joplin lived at the Chelsea Hotel, and have you seen that place? I’d take a hostel full of drunk Australians over the Chelsea Hotel any day.

What does it mean to “move somewhere”?

Just show up and don’t leave. That’s how I “moved” to New York; I was planning to pick up my visa to Saudi Arabia and buy a full-body chador on Atlantic Ave, but then I just stayed. I originally “moved” to Seattle similarly—it was a stop on a cross-country tour and I went to a friend’s house after doing a show and then I… just stayed. I “moved” to Fort Worth by showing up in my car one day, finding a job, and then staying to do the job.

For it to be a move in my book, the only thing required is to relocate your corpus and then stick around. I never owned furniture so “moving” never meant moving stuff. The staying was the thing. In Fort Worth, I stayed for the school year (I got a public school teaching job) and I made some of the concessions a broke person who moves somewhere makes: I bought a mattress and a coffeemaker. I’d just come from Houston where I’d also gotten a job. But I didn’t start that job, didn’t buy a coffeemaker, and I left after a couple weeks. For those reasons, I don’t say I “lived” in Houston, though I technically spent more time at the hostel there in those two summer weeks (Houston is the home of air conditioning, y’all) than I probably spent all year “living” in my Seattle rented apartment.

(Random thing about the hostel in Houston: it’s where the guys who hijacked the planes on 9/11 had stayed the night before they hijacked the planes. It sounds like I have some kind of Saudi Arabia connection. I have no Saudi Arabia connection. I never even went to Saudi Arabia because New York happened to me, so—alas—I never got that sweet sweet Kingdom tax-free income Teaching English as a Foreign Language.)

How long do you have to be somewhere before it’s considered “living” there?

This is a question I am actively answering once again, only now it’s not poetic or charming or rhetorical—it’s for tax purposes. Nothing kills charm quite like tax code, which I was up late reading last night and dying inside.

Currently, I live in Seattle again (very charming) but my mailing address and some other shit is in California (less charming). Washington state, where Seattle is, has no state income tax (kinda charming). California has a shitload of state income tax (offensively un-charming). California’s charm offensive is to try to wear me down by periodically sending me letters saying that I belong to it (and that I owe it a shitload of money unless I can disprove California residency). So I’ve been reading tax code to figure out how to convince California that, if home isn’t merely where the toothbrush is, then it’s where my actual body is, and where my WA driver’s license is, and my motorcycle, and my Pacific Northwest heart. The tax code says nothing about a mattress or a coffeemaker, unfortunately. If I can charm the tax bureaucrat (a modern day Kafka, I hope) who reads my California break up letter, it’ll save me over a thousand bucks a month in taxes this year.

Maybe. California is like a shitty boyfriend—jealous, mooching, gaslighting—who won’t take no for an answer. Case in point: the reason I was once keen to dress in a full-body chador and work as a teacher in Saudi Arabia was that my food and lodging were going to be free and all my earnings I could just keep since the Federal government doesn’t tax Americans who work there (again, I have no Saudi connection! But the US certainly does!). But even though the fucking United States charges you no income tax, California will. As per Example 6 in CA Franchise Tax Board publication 1031, you could tie up all your loose ends and go work in Saudi Arabia all year, which is federal tax-exempt, but you’re still on the hook for California state income tax. What makes a state a mooching boyfriend? That’s a question I have an answer to. When it’s a state that says no, you can’t break up with me, just because you went to a fucking Kingdom halfway across the world last year and earned riyals from a foreign employer doesn’t mean you really left me, we’re still together and you’re mine—and, hey, by the way, do you have a couple thousand bucks?

You’d think that the state with the most high tech would update their laws for a changing world. And they would, but this bad boyfriend shit is worth money. After my twenty-plus years as a flipping-you-off-with-my-middle-digit-al nomad, I would love to draft a more sensible tax code to answer what it means to “live” somewhere and what counts as having “moved.” I can make it as obnoxious as tax code needs to be, just more true to life. It would include things like:

Article 1. Did you buy a coffeemaker? If so, how nice was it?

Article 1a. It was actually espresso machine (this definitely proves you moved)

Article 1b. I got it on Amazon / I use a French press: proceed to Article 2.

Article 2. Fuck your “mailing address,” what is your Amazon Prime shipping address?

Article 3. Are you living here (i.e. living your best life), or are you kind of dead inside?

Article 4. Where were all your Instagram pics taken? That’s a vacation spot. Where were you not taking Instagram pics? That is home.

I’ve always thought of “living in a country” as in “was I there for at least a year”. I now realize I only needed that rule because I wasn’t drinking coffee